Copay Assistance for Generics: Finding Financial Help in 2025

Nov, 21 2025

Nov, 21 2025

Getting your generic prescriptions filled shouldn’t feel like a financial gamble. Even though generics cost 80-85% less than brand-name drugs, many people still struggle to pay their copays-especially if they’re on a fixed income, work multiple jobs, or earn just above Medicaid limits. In 2025, the rules are changing, but the confusion hasn’t gone away. You might think, ‘If it’s cheap, why am I still struggling?’ The answer isn’t simple, but the help is out there-if you know where to look.

Why Generics Still Cost Too Much

Generic drugs are supposed to be the affordable solution. Levothyroxine, metformin, lisinopril-these are the pills millions rely on daily. Yet even at $5 to $15 per prescription, that adds up. Take someone on three generics: $16 for thyroid, $10 for diabetes, $6 for blood pressure. That’s $32 a month, or $384 a year. Not a huge number on paper, but for someone living paycheck to paycheck, it’s enough to skip doses or delay refills.Here’s the catch: while brand-name drug makers often give out copay cards that cut your cost to $0, generic manufacturers almost never do. Why? Thin margins. They’re already selling at rock-bottom prices. So the burden falls on you, the patient, to find help elsewhere.

Medicare’s Extra Help: Your Best Shot

If you’re on Medicare and your income is below 150% of the federal poverty level ($22,590 for one person in 2025), you likely qualify for Extra Help-a federal program that slashes your generic copays to just $4.90 per prescription. That’s not a discount. That’s a fixed rate. No matter how many times you refill, you pay $4.90. For brand-name drugs, it’s $12.15. And if you’re enrolled in Medicaid or SSI, you’re automatically eligible.Before Extra Help, one user on the Medicare Rights Center forum said she paid $45 a month for five generics. After qualifying? $24.50 total. That’s more than half her monthly drug cost gone. But here’s the problem: 41% of applications get denied-not because people don’t qualify, but because paperwork is incomplete. Tax returns, bank statements, proof of income. Miss one document, and you’re stuck waiting months.

Pharmacy Discount Programs: No Application Needed

You don’t need insurance or income verification to use pharmacy discount programs. Walmart, Kroger, Target, and independent pharmacies all run lists of generics priced at $4, $10, or $15. Walmart’s list covers about 150 medications. Kroger’s goes up to $15. SingleCare and GoodRx offer printable or digital coupons that work at most U.S. pharmacies.Here’s the trick: these discounts are not insurance. You can’t combine them with your plan’s copay. But if your insurance copay is higher than the discount price, you can ask the pharmacist to process it as a cash pay. That means you pay $4 instead of $12. Most pharmacists will do it-if you ask. Yet a 2024 study found 62% of patients never even try. Why? They assume the pharmacy will automatically give them the best price. They won’t. You have to speak up.

The Assistance Gap: Too Rich for Medicaid, Too Poor for Help

This is where the system breaks. You make $2,100 a month. You work two jobs. You take three generics. Your out-of-pocket is $32 a month. You don’t qualify for Medicaid because you earn $300 too much. No manufacturer copay cards exist for your meds. Extra Help? Your income is too high. No nonprofit program covers your condition. You’re stuck.This is the ‘assistance cliff.’ An estimated 2.3 million seniors will hit it by 2026. They’re not poor enough for government aid, but not wealthy enough to absorb the costs. And because generic manufacturers don’t offer assistance, there’s no safety net. A 2023 study in Annals of Internal Medicine found that 38% of people who couldn’t afford their generics simply didn’t fill their prescriptions. That’s not laziness. That’s survival.

What’s Changing in 2025

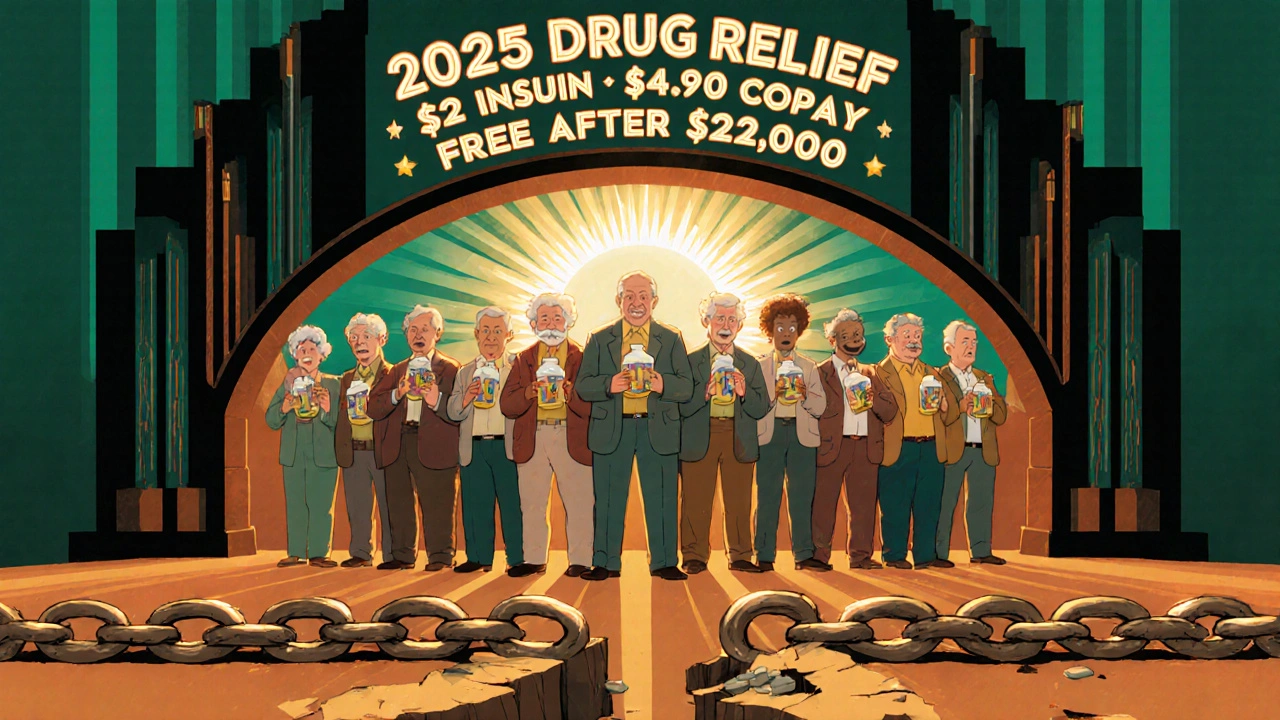

The Inflation Reduction Act is finally rolling out. Starting January 1, 2025, Medicare Part D beneficiaries will have a hard cap of $2,000 per year on out-of-pocket drug costs. That’s down from $8,300. For people on generics, this is huge. Because generics are cheaper, you’ll reach that cap faster. Once you hit it, your drugs are free for the rest of the year.Also in 2025: insulin will cost no more than $2 a month-even the generic versions. Deductibles will be eliminated for Extra Help recipients. And all Part D plans must now guarantee that no beneficiary pays more than $100 per quarter for generics during the coverage gap.

Pfizer and other big players are expanding their patient assistance programs to include more generic drugs. It’s not a flood of new help-but it’s movement. And for the first time, the system is being forced to acknowledge that affordability isn’t just about brand names.

How to Get Help: A Realistic Plan

Don’t wait for help to find you. Here’s what works:- Check Extra Help eligibility at medicare.gov. Use the online screener. Even if you think you earn too much, apply. Rules change, and you might qualify.

- Ask your pharmacist for the cash price on each generic. Compare it to your insurance copay. If cash is lower, pay cash. No need to explain. Just say, ‘Can I pay cash for this instead?’

- Download SingleCare or GoodRx apps. Run your prescriptions through them. Print or show the coupon at checkout. Works even with Medicare.

- Apply for nonprofit help through NeedyMeds or PAN Foundation. Only 17 of their 72 programs cover generic-heavy conditions-but if you have diabetes, hypertension, or thyroid disease, you might qualify. Income must be under 400% of the federal poverty level ($62,600 for one person).

- Don’t skip doses. If you can’t afford a refill, call your doctor. Ask if a different generic is available. Ask about therapeutic interchange-where your pharmacist swaps one generic for another that’s cheaper but equally effective.

What Doesn’t Work

Avoid these traps:- Assuming your insurance will automatically give you the lowest price. It won’t.

- Thinking generic manufacturers offer copay cards. They don’t. Save your time.

- Waiting until you run out of pills to look for help. Apply early. Processing takes 3-6 weeks.

- Ignoring SHIP (State Health Insurance Assistance Program). They offer free, one-on-one counseling. Call 1-877-839-2675.

Final Reality Check

You’re not alone. In 2023, SHIP handled 1.2 million calls about generic drug costs. NeedyMeds processed 417,000 applications. The system is broken for millions-but it’s not hopeless. The changes coming in 2025 will help, but they won’t fix everything. The real power is in your hands: knowing your rights, asking the right questions, and refusing to accept ‘it’s just the cost’ as an answer.Generics are meant to save lives-not drain bank accounts. If you’re paying more than you should, you’re not failing. The system is. And you have more tools to fight back than you think.

Can I use GoodRx with Medicare?

Yes, you can use GoodRx or SingleCare coupons with Medicare-but only if you pay cash instead of using your Medicare Part D plan. If the cash price with the coupon is lower than your Medicare copay, ask the pharmacist to process it as a non-insurance transaction. This is legal and common. Just don’t try to stack it with your insurance-pharmacies can’t combine them.

Why don’t generic drug companies offer copay cards?

Generic manufacturers operate on razor-thin profit margins-often less than 10%. Unlike brand-name companies that charge $1,000 per pill and can afford to give away $8,000 in copay assistance, generics sell for $5. Offering discounts would force them to raise prices just to stay in business. That defeats the whole purpose of generics. So help comes from pharmacies, nonprofits, and government programs instead.

What if I make too much for Medicaid but still can’t afford my meds?

You’re in the ‘assistance gap.’ Apply for nonprofit aid through NeedyMeds or PAN Foundation. Even if your income is above 250% of the federal poverty level, some programs still consider your expenses. Also, check if your state has a State Pharmaceutical Assistance Program (SPAP). Some states, like New York and Pennsylvania, offer extra help to people just above Medicaid limits. And always ask your pharmacist for the cash price-it’s often cheaper than your copay.

Will the $2,000 out-of-pocket cap in 2025 help me if I only take generics?

Yes-more than anyone else. Since generics are cheaper, you’ll hit the $2,000 cap faster than someone taking expensive brand-name drugs. Once you hit it, your prescriptions are free for the rest of the year. For example, if you take five generics at $10 each, you’ll hit the cap after 200 prescriptions-which most people reach within 6-8 months. After that, you pay nothing. That’s a massive win.

Can I get help for insulin if I’m on Medicare?

Yes. Starting January 1, 2025, all Medicare Part D plans must cap insulin at $2.00 per month-no matter if it’s brand-name or generic. This applies to all types of insulin, including Humulin, Novolin, and their generic equivalents. You don’t need to apply. It’s automatic. Just fill your prescription like normal.

What’s the difference between Extra Help and Medicare Savings Programs?

Extra Help reduces your Part D drug costs-copays, deductibles, and premiums. Medicare Savings Programs (MSPs) help pay your Medicare Part B premiums and sometimes copays for doctor visits. You can qualify for both. Extra Help is based on income and assets for drug costs. MSPs are based on income alone. Apply for both through your state’s Medicaid office. Many people get Extra Help without realizing they also qualify for MSPs.

Katy Bell

November 23, 2025 AT 10:22Just got my metformin for $4 at Walmart yesterday. I didn’t even know they had a $4 list until my grandma told me. Seriously, why does no one talk about this?!

Richard Wöhrl

November 24, 2025 AT 23:28Don’t forget to ask for the cash price BEFORE they swipe your insurance card-pharmacists won’t tell you unless you ask. I’ve seen people pay $12 when the cash price was $5. And yes, it’s legal to pay cash even with Medicare. Just say: ‘Can I pay cash instead?’ and they’ll do it. Trust me, I’ve done this 17 times this year.

Ragini Sharma

November 26, 2025 AT 01:43so like… generic drugs are cheap but still too expensive??? like… what even is this system?? i thought we were supposed to be saving money?? 😅

Olanrewaju Jeph

November 27, 2025 AT 01:52As a Nigerian living in the U.S., I can tell you this system is both baffling and heartbreaking. In Lagos, we pay less than $1 for a month’s supply of metformin. Here, even generics are a luxury. The $2 insulin cap is a start-but it’s still a band-aid on a broken leg.

JD Mette

November 28, 2025 AT 06:44Extra Help is the real MVP. I applied last year after my mom got denied three times. Turned out she missed one line on the tax form. Second try? Approved. Took six weeks, but now she pays $4.90 per script. Worth every minute.

Kane Ren

November 29, 2025 AT 14:05You’re not broken. The system is. Keep fighting. You’re doing better than you think.

Suresh Ramaiyan

November 30, 2025 AT 11:08It’s funny how we treat medicine like a luxury item. We’ll spend $8 on coffee every day but hesitate to spend $10 on a pill that keeps us alive. Maybe the real problem isn’t the price-it’s how we’ve normalized suffering as just ‘part of life.’

Jennifer Skolney

November 30, 2025 AT 12:14GoodRx saved my life. 🙏 I take 4 generics. Used to pay $45/month. Now I pay $18. I print the coupons and keep them in my wallet like a superpower. Also-SHIP counselors are angels. Call them. No judgment. Just help.

shreyas yashas

December 1, 2025 AT 15:51I’m from India and I used to think U.S. drug prices were a myth. Then my cousin moved here, on thyroid + diabetes meds. She cried because she had to choose between rent and refills. I didn’t know people here struggled like this. The $2 insulin cap? Long overdue. But why does it take a law to make basic healthcare humane?

Dalton Adams

December 2, 2025 AT 02:00Let’s be real-this whole system is a scam. Pharma companies don’t care about you. They care about profits. And the government? They’re just here to look like they’re helping. The $2,000 cap? Cute. But what about the 2.3 million people who’ll still be stuck in the gap? And why do we even need ‘nonprofit’ help to get basic meds? This isn’t healthcare-it’s a casino.

Charmaine Barcelon

December 2, 2025 AT 20:18You’re all just making excuses. If you can’t afford your meds, you shouldn’t be taking them. Maybe you just need to eat less and save money. Or get a better job. It’s not that hard.

Karla Morales

December 2, 2025 AT 21:20📊 Data point: 38% of patients skip doses due to cost. 📉

📉 62% of patients don’t ask for cash prices.

💡 Solution: Ask. Always.

🚨 System failure: $2,000 cap doesn’t help until you hit it. That’s 6-8 months of suffering.

🔑 Pro tip: Use GoodRx + Walmart + SHIP. Triple-layer defense.

✅ You’re not lazy. The system is rigged.

Javier Rain

December 4, 2025 AT 19:06Just got approved for Extra Help last week. I was terrified to apply-thought I made too much. Turns out, I didn’t. Now I pay $4.90 for everything. I cried in the pharmacy. Not because I was happy. Because I realized I spent 18 months thinking I was weak for struggling. I wasn’t weak. I was just stuck in a broken system. Thank you for writing this. It helped me feel less alone.

Brandy Walley

December 5, 2025 AT 14:32Wow so much crying and drama. Just buy generic. They’re cheap. If you can’t afford $32 a month, maybe you shouldn’t be on so many meds. Just sayin’.