How Medicare Drug Price Negotiations Work and What It Means for Your Prescription Costs

Jan, 19 2026

Jan, 19 2026

For decades, Medicare couldn’t negotiate drug prices. Even though it paid billions every year for medications like Eliquis, Jardiance, and Xarelto, the government had no legal power to ask manufacturers for a better deal. That changed in 2022, when the Inflation Reduction Act gave Medicare the right to negotiate prices for the most expensive single-source drugs. Starting January 1, 2026, the first wave of negotiated prices kicks in - and the discounts are huge. Some drugs are getting 79% off their old list prices.

What drugs are affected and why these 10?

The first 10 drugs chosen for negotiation weren’t picked randomly. They had to meet three strict rules: they must be single-source (no generics or biosimilars), have been on the market for at least 7 years (or 11 for biologics), and cost Medicare more than $100 million annually. That’s how CMS narrowed it down from hundreds of options to just 10. These drugs accounted for over $50 billion in Medicare spending in 2022 alone. Eliquis, used for blood clots, was the biggest - $6.3 billion in annual costs. Others include Jardiance for diabetes, Xarelto for stroke prevention, and Farxiga, which is on the next round for 2027.How the negotiation process actually works

It’s not like haggling at a car dealership. The process is tightly controlled by law. On February 1, 2024, CMS sent each drugmaker an initial offer - not a guess, but a math-based calculation using real data. That included what other insurers paid, how many people used the drug, and whether cheaper alternatives existed. The drug companies had 30 days to respond with a counteroffer. Then came three face-to-face meetings between CMS and each manufacturer between March and July 2024. Five of the 10 companies agreed during those meetings. The other five reached deals through final written offers. The final price, called the Maximum Fair Price (MFP), can’t go above two limits: either the average price Medicare paid last year (after rebates), or a percentage of the drug’s average market price. CMS didn’t just take the lowest bid - they had to prove they could walk away. That’s what made the difference. If a company refused to budge, CMS was ready to set the price anyway. And they did.How big are the discounts? Real numbers

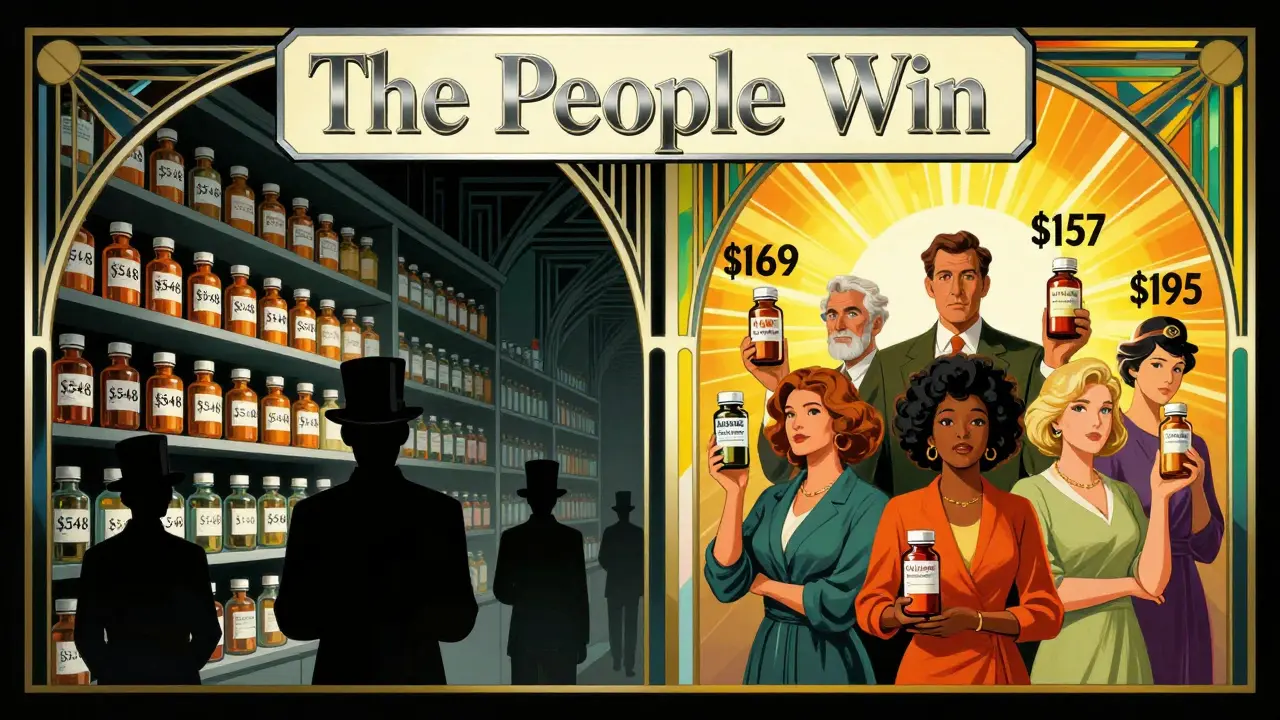

The Department of Health and Human Services released the final numbers in August 2024. The average discount across the 10 drugs was 63%. But the range was wide. One drug dropped 79%. Another only dropped 38%. Why the difference? It came down to how much leverage CMS had. Drugs with more alternatives - like other diabetes pills or blood thinners - got bigger cuts. Drugs with no close substitutes, even if expensive, saw smaller drops because Medicare had fewer options to switch to. For example, Eliquis went from $548 per 30-day supply to $169. That’s a 70% cut. Jardiance dropped from $520 to $157 - 70% off. Xarelto went from $525 to $195. That’s a 63% discount. These aren’t theoretical. These are the prices that will appear on your Medicare Part D statement starting January 1, 2026.

What this means for you - patient to patient

If you’re on Medicare and take one of these drugs, your out-of-pocket costs will drop. Right away. The biggest relief comes for people stuck in the “donut hole” - that gap where you pay full price after your initial coverage runs out. Before this, some people paid over $1,000 a month for a single drug. Now, that same drug could cost under $200. Even if you’re past the donut hole and in catastrophic coverage, you’ll still pay less because your coinsurance is based on the new lower price. But here’s the catch: your plan might swap your drug for a different one. If your doctor prescribed Eliquis and the plan now covers a cheaper blood thinner, they might switch you automatically. You can request to stay on the original drug, but you’ll pay more. That’s why it’s important to check your plan’s formulary this fall. Pharmacies will update their systems by October 15, 2025, so you’ll know exactly what’s covered and at what price.What about other insurers? Will private plans get discounts too?

Yes - but indirectly. Medicare’s new prices are becoming the new benchmark. Private insurers, pharmacy benefit managers (PBMs), and even the VA are watching closely. If Medicare can get a drug for $169, why should a private insurer pay $548? Some are already adjusting their contracts. The Pharmaceutical Care Management Association estimates private insurers could save $200-250 billion over the next decade just from this ripple effect. It’s not a direct cut - but it’s a powerful signal. Drugmakers now know that if they don’t offer fair prices to Medicare, they’ll lose market share across the board.What’s next? The 2027 list and beyond

The program isn’t stopping. In January 2024, CMS announced the next 15 drugs for 2027 pricing. Farxiga, Stelara, and Ozempic are on that list. The same rules apply: 7+ years on the market, no generics, high cost. By 2028, Medicare will start negotiating drugs given in doctor’s offices - like cancer infusions and rheumatoid arthritis shots. That’s Part B. The reimbursement model changes here too. Doctors used to get paid 6% over the drug’s average price. Now they’ll get 6% over the new negotiated price. That could mean less income for some practices, which is why the American Medical Association is pushing for adjustments. By 2029, 20 drugs will be negotiated every year. That’s 80 drugs by 2031. The Congressional Budget Office estimates total savings of $98.5 billion by then. Some experts say it could be more - up to $112 billion - because the first round went better than expected.

Why drugmakers are fighting back

Four of the 10 companies sued, claiming the law was unconstitutional. Their argument? The government can’t force them to sell at a loss. But in August 2024, a federal judge dismissed all four lawsuits. Appeals are expected, but the legal foundation is holding. Meanwhile, PhRMA, the drug industry group, warned that innovation would drop by $112 billion over 10 years. But the Office of Management and Budget called those numbers “significantly overstated.” Real-world data shows innovation hasn’t slowed in countries like Canada and Germany, where governments have negotiated prices for decades.What you should do now

If you’re on Medicare and take a high-cost drug, here’s what to do:- Check your 2026 Medicare Part D plan materials - they’ll arrive in October 2025.

- Look for your drug on the list of 10 negotiated drugs.

- See if your plan is switching you to a different drug. You can opt out, but you’ll pay more.

- Talk to your doctor about alternatives - especially if your drug is on the 2027 list.

- Don’t assume your discount will be automatic. Confirm with your pharmacy.

Will this lower prices for everyone?

Not overnight. The program only hits drugs that are old, expensive, and have no competition. Newer drugs - like the latest GLP-1 weight-loss drugs - won’t be eligible until 2030 or later. But it’s a turning point. For the first time, the federal government is using its buying power to control costs. And it’s working. The discounts are real. The savings are happening. And more drugs are coming.This isn’t just about Medicare. It’s about resetting the entire U.S. drug pricing system. When the government sets a fair price, the market follows. And for the first time in 20 years, patients are winning.

Which drugs are getting price cuts in 2026?

The 10 drugs getting price cuts starting January 1, 2026, are: Eliquis (apixaban), Jardiance (empagliflozin), Xarelto (rivaroxaban), Ibrance (palbociclib), Januvia (sitagliptin), Farxiga (dapagliflozin), Enbrel (etanercept), Repatha (evolocumab), Trelegy (fluticasone furoate/umeclidinium/vilanterol), and Entresto (sacubitril/valsartan). These were selected because they’re expensive, have no generic alternatives, and have been on the market for at least 7 years.

How much will my prescription cost after the price cut?

Your out-of-pocket cost depends on your Medicare plan and coverage stage. For example, Eliquis dropped from $548 to $169 per 30-day supply - a 70% cut. If you’re in the donut hole, you’ll pay 25% of the new price, which could drop your monthly cost from $1,000 to under $40. If you’re in catastrophic coverage, your coinsurance will be based on the lower price, so your monthly bill will go down too. Check your plan’s formulary in October 2025 for exact numbers.

Will my doctor still prescribe my current drug?

Your doctor can still prescribe your current drug, but your Medicare plan might automatically switch you to a cheaper alternative. If you want to stay on your original drug, you can request a coverage exception. But you’ll pay more - sometimes much more. Talk to your doctor and pharmacist early in 2025 to understand your options before the new prices take effect.

Are these price cuts permanent?

Yes, the negotiated prices are binding for 2026 and will be reviewed annually. The government can adjust them based on new data, but manufacturers can’t raise prices above the Maximum Fair Price without losing Medicare coverage. The discounts are locked in for the year, and future years will have new negotiated prices based on updated data.

Why weren’t newer drugs like Ozempic included in the first round?

The law requires drugs to be at least 7 years old (or 11 for biologics) before they’re eligible. Ozempic was approved in 2017, so it becomes eligible in 2024 - but it’s on the 2027 list because negotiations happen a year in advance. That means Ozempic’s price will be negotiated in 2026 and take effect in 2027. The delay was intentional - to protect innovation in newer drugs while targeting older, high-cost ones.

Do these price cuts apply to people with private insurance?

Not directly. But many private insurers use Medicare’s negotiated price as a benchmark. If Medicare pays $169 for Eliquis, private plans are likely to cap their payments at or near that amount. Some PBMs have already started adjusting their contracts. So while you won’t see the same discount on your private plan, you’ll likely see lower prices over time as the market adjusts.

What if I can’t afford my drug even after the cut?

Even with the discount, some drugs may still be expensive. You can apply for Medicare’s Extra Help program, which lowers out-of-pocket costs for low-income beneficiaries. You can also ask your pharmacy about manufacturer coupons or patient assistance programs. Some drugmakers still offer discounts outside of Medicare - even after negotiation.

Coral Bosley

January 20, 2026 AT 01:35My Eliquis bill used to eat my Social Security check. Now I can afford to buy groceries too.

Steve Hesketh

January 20, 2026 AT 21:02shubham rathee

January 21, 2026 AT 11:45MAHENDRA MEGHWAL

January 21, 2026 AT 15:37Kevin Narvaes

January 23, 2026 AT 03:00Dee Monroe

January 23, 2026 AT 20:33Sangeeta Isaac

January 25, 2026 AT 05:42Alex Carletti Gouvea

January 26, 2026 AT 09:56Philip Williams

January 27, 2026 AT 13:53Ben McKibbin

January 29, 2026 AT 12:36Melanie Pearson

January 31, 2026 AT 08:57Rod Wheatley

January 31, 2026 AT 18:48Jerry Rodrigues

February 1, 2026 AT 03:39