Out-of-Pocket Maximums: How Generic Copays Count Toward Deductibles in Health Insurance

Dec, 15 2025

Dec, 15 2025

Every year, millions of people pay their prescription copays without realizing they’re not helping them meet their deductible. That’s not a mistake-it’s how most health plans are designed. If you’re on a generic medication like metformin or lisinopril, you might be paying $10 or $15 every month, thinking those payments are chipping away at your $2,000 deductible. But here’s the truth: generic copays usually don’t count toward your deductible. They do, however, count toward your out-of-pocket maximum. And that difference can save you thousands.

What’s the difference between a deductible and an out-of-pocket maximum?

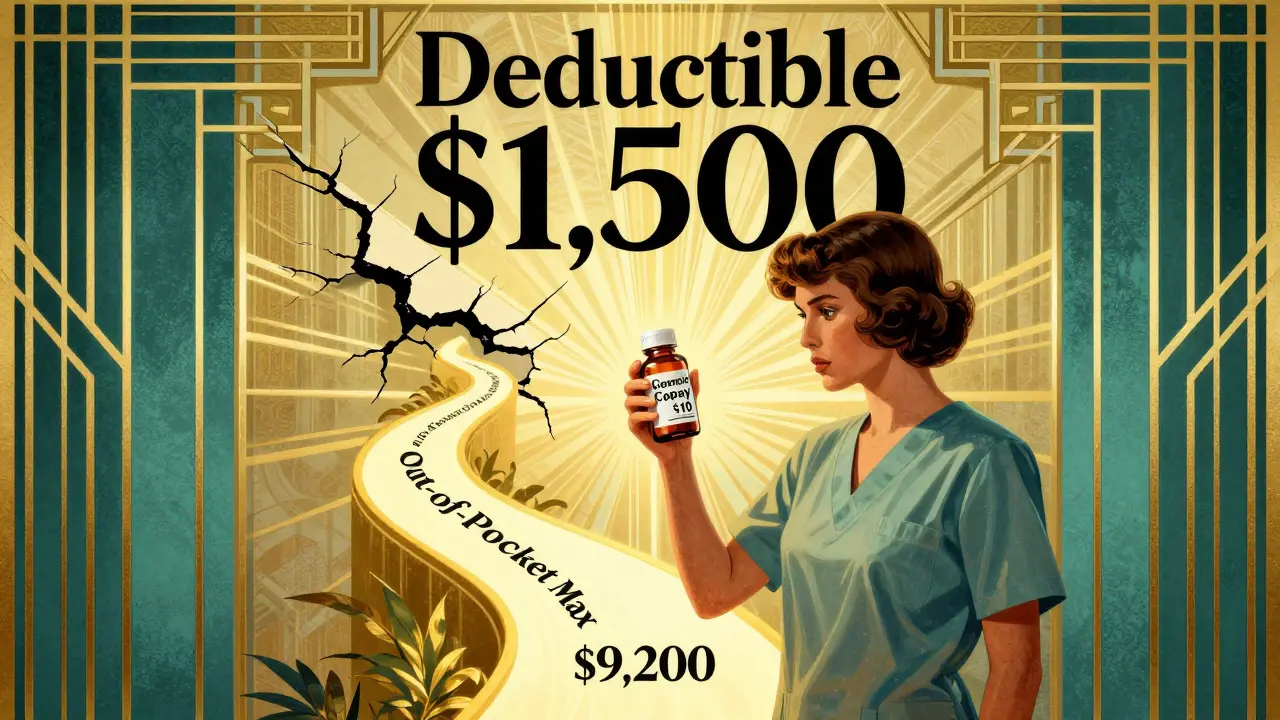

Your deductible is the amount you pay for covered services before your insurance starts sharing the cost. For example, if your deductible is $1,500, you pay 100% of medical bills until you hit that number. After that, you usually pay coinsurance-say, 20%-while your plan covers 80%.

Your out-of-pocket maximum is the most you’ll pay in a year for covered care. Once you hit it, your insurance pays 100% of everything else for the rest of the year. In 2025, the federal limit for individual plans is $9,200. For families, it’s $18,400.

Here’s the key: your deductible is just one part of your out-of-pocket maximum. The rest includes copays and coinsurance. So even if your copays don’t move your deductible, they still move you closer to that upper limit.

Why don’t generic copays count toward your deductible?

It’s not a loophole-it’s intentional design. Before 2014, copays didn’t count toward anything. You paid them, and they vanished from your financial record. The Affordable Care Act changed that by requiring all cost-sharing to count toward your out-of-pocket maximum. But it didn’t force plans to combine copays with deductibles.

Why? Because insurers wanted to keep premiums lower. If every copay counted toward your deductible, plans would have to raise premiums to cover the faster loss of cost-sharing revenue. So they created a two-layer system:

- Deductible layer: You pay full cost for services until you hit the deductible.

- Copay layer: You pay a fixed fee for prescriptions or visits, but those fees don’t reduce your deductible.

For example, say your plan has a $1,500 medical deductible and a $10 generic drug copay. You fill your blood pressure med every month for 12 months. You pay $120 in copays. That $120 goes toward your $9,200 out-of-pocket maximum-but it doesn’t reduce your $1,500 deductible. You still owe $1,500 before your insurance kicks in for doctor visits or hospital stays.

How do prescription costs actually work in different plan types?

Not all plans are the same. There are three main structures:

- Single deductible: One number covers both medical and prescriptions. You pay full cost for all services until you hit it. After that, you pay coinsurance. Only 27% of employer plans use this model.

- Separate deductibles: You have one deductible for doctor visits and another for prescriptions. You might pay $1,000 for medical care and $500 for prescriptions. Once you hit each, copays kick in. This is the most common model-used in 37% of plans.

- Copay-only (no prescription deductible): You pay your $10 or $15 copay right away, no deductible to meet. But again, those copays don’t count toward your medical deductible. This is used in 36% of plans.

If you’re on a separate deductible plan, your $10 generic copay only counts toward your prescription deductible. Once you hit that, you pay the copay, and it counts toward your overall out-of-pocket maximum. But it still doesn’t touch your medical deductible.

What happens when you hit your out-of-pocket maximum?

This is where the system shines.

Let’s say you have a chronic condition like diabetes. You take insulin, metformin, and a blood pressure pill-all generics. You pay $15 for each monthly prescription. That’s $180 a year. You also visit your endocrinologist four times a year with a $30 copay each time. That’s $120. You’ve paid $300 in copays so far.

Then you break your ankle. You need an MRI, surgery, and physical therapy. Those bills add up to $8,000. You pay coinsurance on that-say, 20%, so $1,600. Your total out-of-pocket so far: $300 + $1,600 = $1,900.

You keep paying your $15 copays for meds. By October, you’ve paid $600 in copays and $4,000 in coinsurance. You’re at $4,600. You hit your $9,200 out-of-pocket maximum in November. From that point on, your insurance pays 100% of everything-your insulin, your follow-up visits, even that new knee brace you need.

Without the out-of-pocket maximum, you’d still be paying $15 every month for your meds, even after you’ve paid $9,000 in costs. The ACA fixed that.

Why so many people get confused

A 2023 survey found that 68% of people think their prescription copays count toward their deductible. Only 22% got it right.

It’s not their fault. Plan documents are confusing. The Summary of Benefits and Coverage (SBC) form is supposed to be clear-but many people skip reading it. One user on HealthCare.gov wrote: “I paid $10 copays for my meds all year. I thought I’d met my $2,000 deductible. I hadn’t. I still paid full price for my MRI.”

Another common trap: “prescription deductible.” Some plans have a separate $500 or $1,000 deductible just for drugs. You pay full price for prescriptions until you hit that number. Then copays start. But that prescription deductible doesn’t help you meet your medical deductible. It’s a silo.

That’s why the Department of Health and Human Services announced new rules in April 2024: plans must clearly label whether copays count toward the deductible or not. Starting in 2025, every SBC must include a column that says: “Does this payment count toward your deductible?”

What should you do?

Don’t guess. Don’t assume. Don’t rely on memory.

- Find your plan’s Summary of Benefits and Coverage (SBC). It’s sent to you before open enrollment. Look for the “Cost-Sharing” section.

- Check the “Deductible” line. Does it say “medical only” or “combined”? If it says “medical,” your prescriptions are separate.

- Look for “Prescription Drug Deductible.” If it exists, you have a separate deductible for meds.

- Find the “Out-of-Pocket Maximum” line. Make sure it says “includes copays.” It should.

- Write down your annual copay costs. Multiply your monthly generic med cost by 12. Add in your doctor visit copays. That’s your yearly copay burden.

- Track your spending. Use a spreadsheet or phone app. When you’re close to your out-of-pocket maximum, call your insurer and ask: “How much have I paid so far?”

Some people with chronic conditions have seen real savings. One user on PatientsLikeMe said: “I reached my $8,500 out-of-pocket max last June. My insulin went from $15 to $0. That’s $180 a month I didn’t have to pay. It changed my life.”

The future: Will copays start counting toward deductibles?

There’s pressure to change. McKinsey & Company predicts that by 2027, 60% of major insurers will offer at least one plan where generic copays count toward the deductible. Why? Because consumers are fed up. The current system causes people to skip meds because they think they’re “already paying too much.” The Congressional Budget Office estimates this confusion leads to $15 billion in missed prescriptions every year.

Some states are testing “integrated deductible” models where all costs-doctor visits, hospital stays, prescriptions-count toward one number. Early results show 28% higher medication adherence. That’s good for health. It’s also good for insurers-people who take their meds don’t end up in the ER.

But there’s a catch. Combining deductibles could raise premiums by 3-5%. Insurers argue that if you make it easier to meet your deductible, people will use more care, and costs will rise. It’s a trade-off: simplicity vs. affordability.

For now, the system stays as it is. But the writing is on the wall. The next five years will see more plans simplify how copays work. Until then, you need to know the rules of your plan.

Final tip: Know your plan before you need it

Health insurance isn’t like car insurance. You don’t just pay and forget. You have to understand how your money flows. If you’re on a generic medication, you’re paying it every month. Make sure you know whether those payments are helping you reach your deductible-or just your out-of-pocket maximum.

Don’t wait until you’re in the hospital to figure it out. Spend 15 minutes right now. Open your plan documents. Find the SBC. Look at the cost-sharing table. Write down your numbers. That’s the only way to avoid a nasty surprise.

Because in health insurance, the difference between $15 and $0 isn’t just about money. It’s about whether you can afford to stay healthy.

Do generic prescription copays count toward my deductible?

In most cases, no. Generic copays usually do not count toward your medical deductible. They are treated as a separate cost-sharing mechanism. However, they do count toward your overall out-of-pocket maximum. Always check your plan’s Summary of Benefits and Coverage to confirm how your specific plan works.

Do copays count toward my out-of-pocket maximum?

Yes. Under Affordable Care Act rules, all in-network cost-sharing-including copays, coinsurance, and your deductible-counts toward your out-of-pocket maximum. This means every $10 you pay for a generic prescription adds to your annual spending limit. Once you hit that limit, your insurance pays 100% of covered services for the rest of the year.

What’s the difference between a medical deductible and a prescription deductible?

A medical deductible applies to doctor visits, hospital stays, and other medical services. A prescription deductible applies only to medications. In plans with separate deductibles, you must meet each one individually. For example, you might pay $1,000 for medical care and $500 for prescriptions before copays kick in. Copays paid after meeting the prescription deductible count toward your out-of-pocket maximum, but not toward your medical deductible.

How do I know if my plan has a separate prescription deductible?

Check your plan’s Summary of Benefits and Coverage (SBC). Look for a line labeled “Prescription Drug Deductible.” If it has a dollar amount (like $500), you have a separate deductible for medications. If it says “$0” or “Not Applicable,” your prescriptions are either covered under a single deductible or you pay copays right away with no deductible.

What happens if I pay more than my out-of-pocket maximum?

You won’t pay more. Once you hit your out-of-pocket maximum, your insurance covers 100% of all covered services for the rest of the plan year. Any additional copays, coinsurance, or other cost-sharing charges are paid by your insurer. This includes prescriptions, doctor visits, lab tests, and hospital stays. Make sure to track your spending so you know when you’ve reached this limit.

Are premiums included in the out-of-pocket maximum?

No. Monthly premiums are not included in your out-of-pocket maximum. Only the money you pay when you use care-deductibles, copays, and coinsurance-counts. Premiums are what you pay just to keep your insurance active, regardless of whether you use any services.

Can I reach my out-of-pocket maximum just by paying for generic meds?

It’s unlikely for most people, but possible if you have multiple chronic conditions and high-cost generics. For example, if you take 5 different generic medications at $30 each per month, that’s $1,800 a year. Add in doctor visits and lab tests with copays, and you could reach your out-of-pocket maximum. People with complex conditions often do. That’s why the out-of-pocket maximum exists-to protect those who need the most care.

Christina Bischof

December 15, 2025 AT 04:05Jocelyn Lachapelle

December 16, 2025 AT 01:06Mike Nordby

December 17, 2025 AT 11:45John Samuel

December 17, 2025 AT 22:20Sai Nguyen

December 19, 2025 AT 20:14Michelle M

December 21, 2025 AT 10:56Lisa Davies

December 21, 2025 AT 23:52Nupur Vimal

December 22, 2025 AT 18:07Cassie Henriques

December 22, 2025 AT 18:32Jake Sinatra

December 22, 2025 AT 20:01